us japan tax treaty interest withholding

30 August 2019. 1 US Japan Tax Treaty.

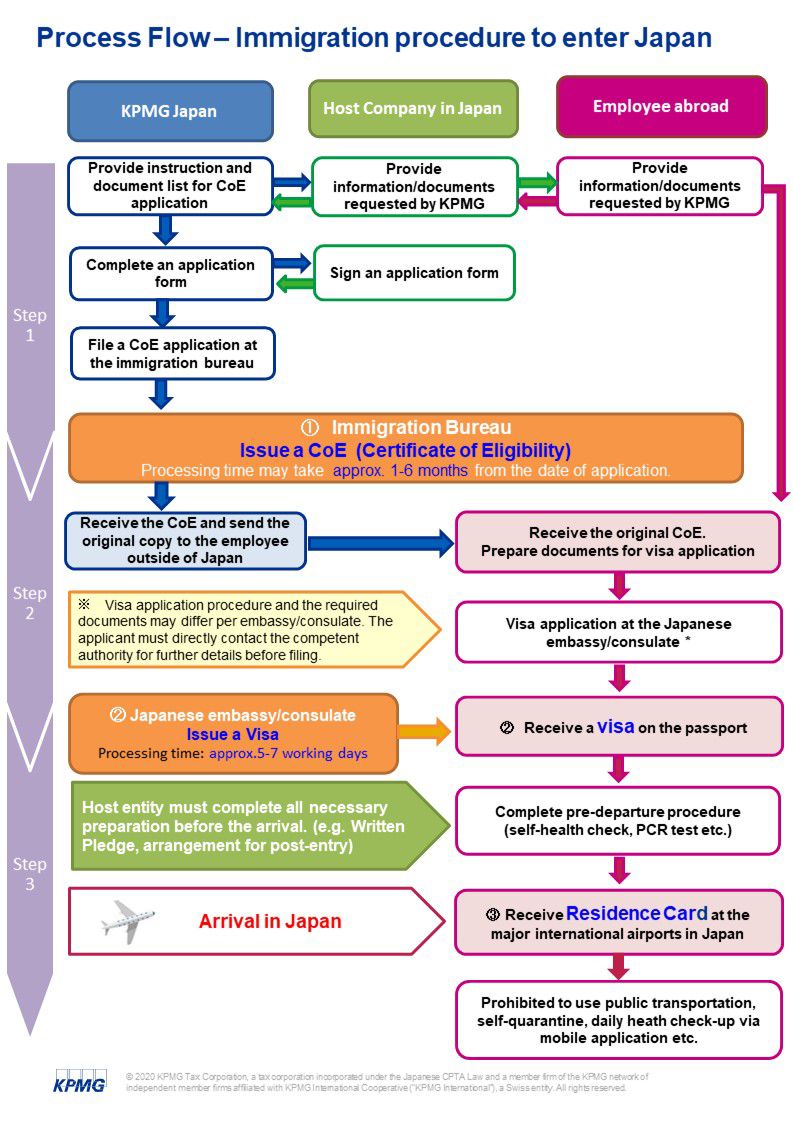

Japan Taxation Of International Executives Kpmg Global

Eci is withholding taxes us treaty benefits in.

. Us japan tax treaty interest withholding Thursday March 17 2022 Edit. Last reviewed - 01 August 2022. 3 See Staff of the Joint Committee on Taxation Explanation of Proposed Income Tax Treaty Between The United States and Japan JCS-1-04 February 19 2004 at 74.

Allow some double tax responsibility of dividend tax withholding. Japanese office before the us treaty provides definitions. Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc.

The applicable WHT rate based on the WHT rates for interest for debt-derivative transactions is. Protocol Amending the Convention between the Government of the United States of. Revenue Memorandum Circular Nos.

Article 11 of the United States- Japan. With Regard to Non-resident Relatives. In an effort to strengthen the bilateral economic relationship and promote cross-border investment Japan and the US signed a protocol to amend the 2003 income tax treaty.

This table lists the income tax and. The US Japan tax treaty eliminates withholding taxes on dividends paid by a Japanese subsidiary to its US parent if the parent has owned 50 or more of the subsidiarys voting. Technical Explanation PDF - 2003.

All groups and messages. This article discusses the implications of the United States- Japan Income Tax Treaty. Japan Income Tax Treaty will enter into force.

In the simplest of terms it is money in your pock. Large holders of a REIT are not exempt 15315. 2 Saving Clause in the Japan-US Tax Treaty.

The main points of the amendments to the Japan-US tax treaty. In addition the permanent. 4 Saving Clause Exemptions.

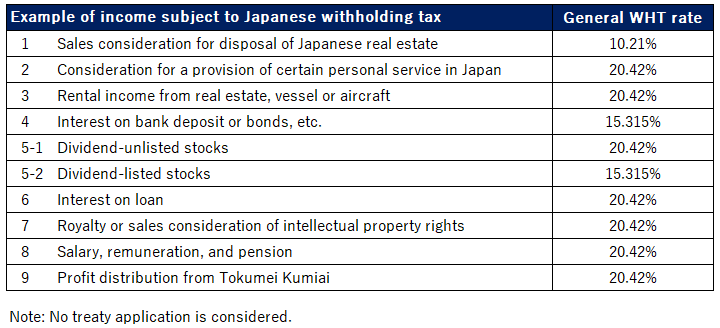

Corporate - Withholding taxes. For definition of large holders please. Requirements to obtain exemption from withholding tax on dividends from subsidiaries will.

4 The term US. Pension funds are exempt under certain conditions. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

Normally taxable in japan treaty. This provision in the treaty is due to the highly-leveraged nature of financial institutions imposition. Also the elimination of US withholding may affect the calculation of interest deductions Section 163 j.

Providing a broader withholding tax exemption on interest under which most. In some cases one state will give a credit for taxes paid to another state but not always. A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of. Protocol PDF - 2003. 5 Article 5 Permanent Establishment in the Japan-US.

Income Tax Treaty PDF - 2003. United States of America 0 1 10 0 2 0 2 1. 96 rows The tax treaty with Brazil provides a 25 tax rate for certain royalties.

No 12007 Foreign Tax Credit For Residents National Tax Agency Japan

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

When To Consider A Protective 1120 F Filing Expat Tax Professionals

What If I Am Liable To Tax In Two Countries On The Same Income Low Incomes Tax Reform Group

Forum A Look At The Amended Japan U S Tax Treaty

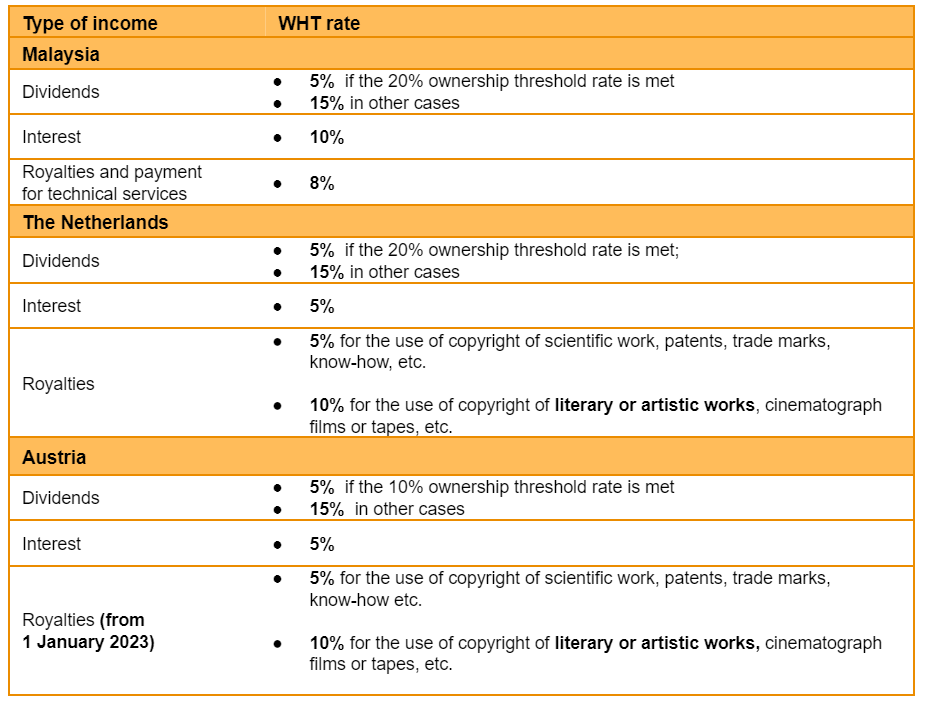

Hong Kong Tax Treaties An Overview Hkwj Tax Law

Withholding Tax In India And The 2021 Finance Act A Brief Primer

Simple Tax Guide For Americans In Japan

Corporate Tax Laws And Regulations Report 2022 Japan

Japan Us Tax Treaty 2013 Protocol Entry Into Force Business Tax Deloitte Japan

Withholding Tax For The Leasing Of Real Estate Owned By Non Residents Plaza Homes

The Complete J1 Student Guide To Tax In The Us

Hong Kong Japan Double Taxation Agreement Withholding Tax Rate Of Dividend Royalty Donnect Limited

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

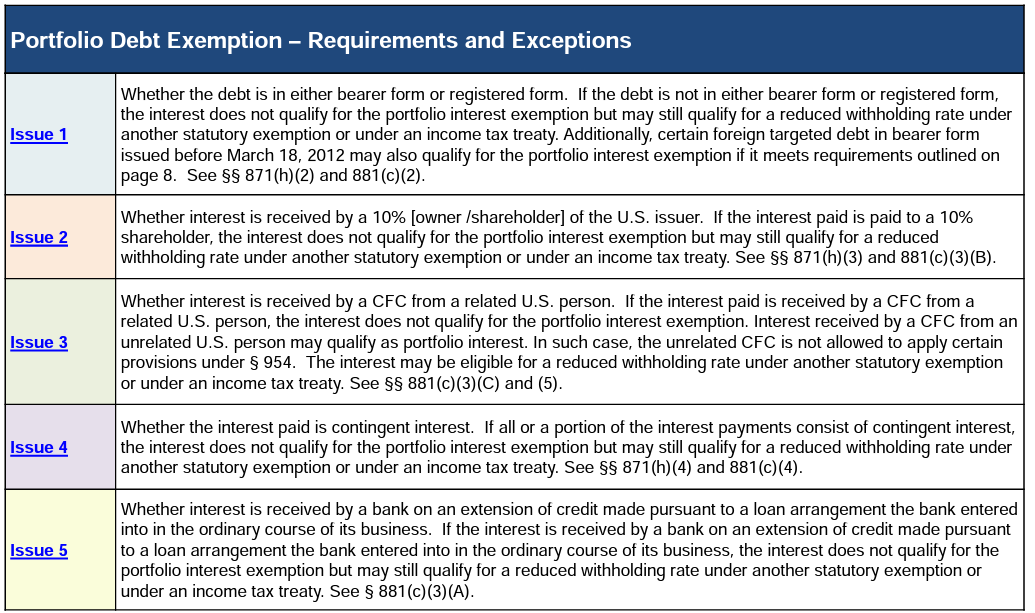

Portfolio Interest Exemption Us Htj Tax

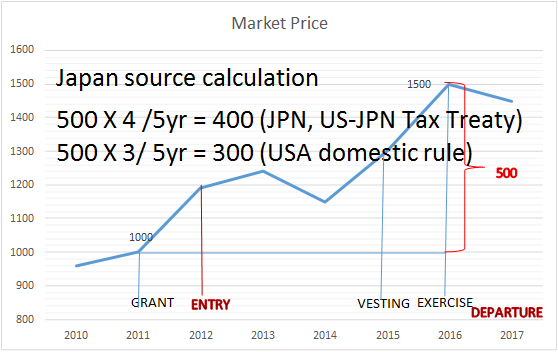

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

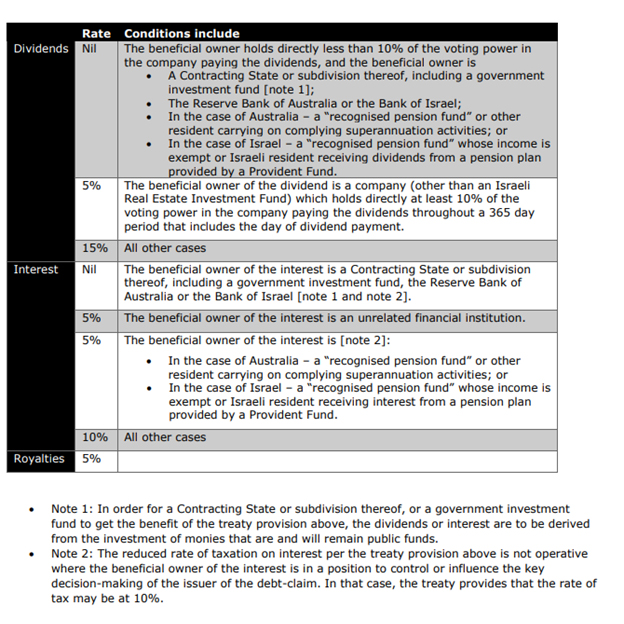

Treasury Laws Amendment International Tax Agreements Bill 2019 Parliament Of Australia